how much is vehicle tax in kentucky

Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky.

Ifta Fuel Tax Return Mandatory For Motor Carriers Operating Interstate Tax Return Tax Permit

It is levied at six percent and shall be paid on every motor vehicle used in.

. A portion of the fees collected in this transaction includes funds to develop maintain and enhance the states official web portal Kentuckygov. A 200 fee per vehicle will be added to cover mailing costs. The taxable value of cars leapt by about 40 between 2021 and 2022 because Kentucky uses national car value estimates to decide how much people will be taxed and used car prices skyrocketed during.

Payment methods include American Express Discover MasterCard or VISA. Every year Kentucky taxpayers pay the price for driving a car in Kentucky. 5 rows Since Kentucky sales tax is simply 6 of the total purchase price estimating your sales tax.

2450 6 to transfer. Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1257 annually. In 2022 the owner will pay 193 a 45 percent increase from the prior year.

On used vehicles the usage tax is 6 of the current average retail as listed in the Used Car Guide or 6 of the total consideration paid. If you are unsure call any local car dealership and ask for the tax rate. Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public.

Users are instructed to input their VIN and instructions are provided as to where their VIN can be found. 05 privilege tax on new vehicle purchases. Sticker shock in 2022 isnt just in store for those shopping for new vehicles or are finding that used vehicles arent as.

In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees. The look-up for vehicle tax paid in 2020 is available at the bottom of the drivekygov homepage. Vehicle Tax paid in.

Of course where you choose to live in Kentucky has an impact on your taxes. 122-152 depending on model year and MPG. 2000 x 5 100.

In fact the typical homeowner in Kentucky pays just 1257 each year in property taxes which is much less than the 2578 national median. Dealership employees are more in tune to tax rates than most government officials. 6 Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

On used vehicles the usage tax is 6 of the current average retail as listed in the Used Car Guide or 6 of the total consideration paid. In the case of new vehicles the retail price is the total consideration given The consideration is the total of the cash or amount financed and the value of any vehicle traded in or 90 of the manufacturers suggested retail price MSRP including. Search tax data by vehicle identification number for the year 2020.

246 cents per gallon of regular gasoline 216 cents per gallon of diesel. Vehicle Tax paid in 2020. What happened was that those assessments went up quite a bit just due to the weird circumstances of the.

Vehicle tax bills to see big jump is 2022. 2020 Vehicle Tax Information. Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all other taxes imposed by the Commonwealth.

For used cars 20 on the 1st 1500 of value 325 of the remainder. Depending on where you live you pay a percentage of the cars assessed value a price set by the state. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky.

Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. Payment methods include VISA MasterCard Discover or American Express. 10 in Medford 21 in Portland.

Usage Tax-A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. Once you have the tax rate multiply it with the vehicles purchase price. Its fairly simple to calculate provided you know your regions sales tax.

Retail Tax could be 6 of the current average retail listed in the NADA Used Car Guide 6 of the sale price or 90 of the MSRP Manufacturers Suggested Retail Price for new vehicles. 083 average effective rate. The tax is collected by the county clerk or other officer with whom the vehicle is.

Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. 98-113 depending on model year and MPG. Kentucky bases its assessments on those values including the property tax of vehicles.

The non-refundable online renewal service fee is a percentage of the transaction total and is assessed to develop and maintain the Online Kentucky Vehicle Registration Renewal Portal. In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees. How much will my car taxes be in KY.

Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. Excise tax of 325 for a new vehicle. 10 lien processing fee.

The owner of a 2019 Toyota Camry LE paid 20269 in automobile taxes in 2021 based on a NADA trade in value of 16660. You can find these fees further down on the page. The states average effective property tax rate annual tax payments as a percentage of home value is also low at 083.

A 200 fee per vehicle will be added to cover mailing costs.

Ford Kentucky Truck Plant Factory Tour Trucks Diesel Trucks Big Trucks

What Is Irp Plates Renewal Irs Forms Trucking Companies Renew

Wkyt Investigates Rising Car Taxes

Pin On Global Multi Services Inc

Sales Tax On Cars And Vehicles In Kentucky

Things That You Must Know About Irp Cab Card Correction Registration Paying Taxes Tracking Expenses

Cash For Your Car In Kentucky Free Same Day Pickup Car Title Kentucky Id Card Template

August 8 2019 Issue Of The Smoky Mountain Trader Weekly Smokies Smoky Mountains Sevierville

Kentucky Vehicle Inspection Form 15 Things To Avoid In Kentucky Vehicle Inspection Form Vehicle Inspection Vehicle Maintenance Log Inspection Checklist

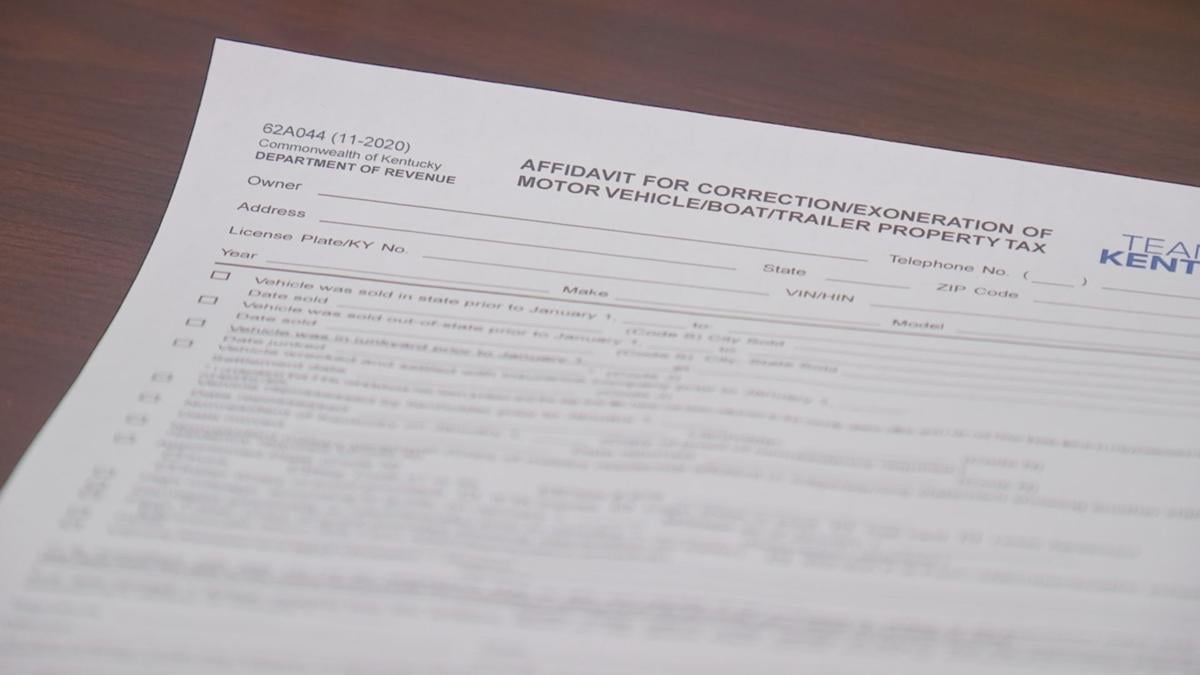

Kentucky Vehicle Valuations Increase By 40 Here S What You Can Do If Your Car S Value Jumps This Year News Wpsd Local 6

Pin By Roberto Alejandro On Autos Nissan Frontier 4x4 Nissan Frontier Nissan

Motor Vehicle Taxes Department Of Revenue

Global Multiservices Contact Us Today To Discuss Your Ifta Filing Assistance Options Tax Return Truck Stamps Global

Title Transfer Or Title Registration Global Multi Services Truck Stamps Trucking Companies Commercial Vehicle

Global Multi Services For Irp New Carrier Renew Tracking Expenses Service

Mileage Log Form For Taxes Lovely Mileage Log For Tax Deduction Template Templates Party Invite Template Christmas Party Invitation Template